uniswap labs frontend revenue

It’s pretty well understood that most retail onchain users today are execution insensitive. Last week, Uniswap Labs started charging 15bps on swaps for select trading pairs on the frontends they maintain. Charging for maintaining a quality frontend is definitely fine, and users can choose to swap elsewhere if they are not comfortable with the fee. 15bps is also much lower than fees on some other retail interfaces: Metamask Swaps charges 87.5bps and Maestro charges 100bps.

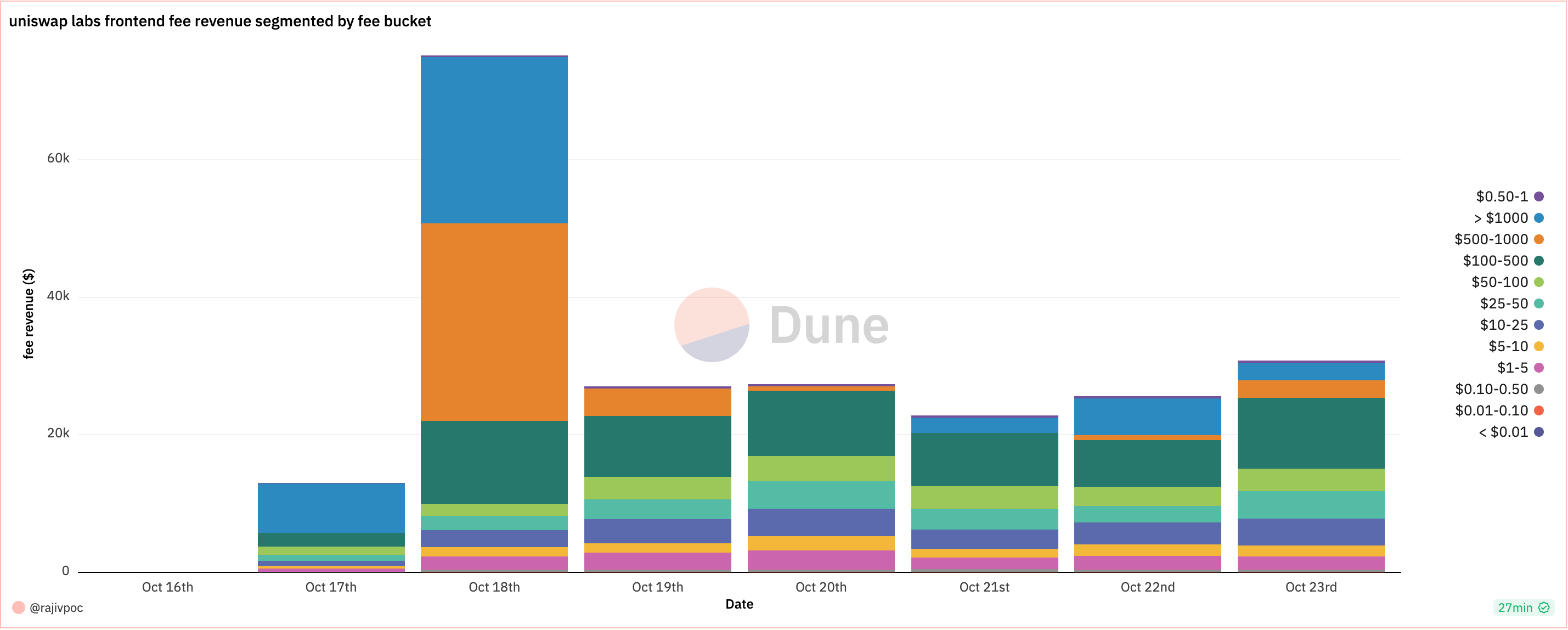

While we won’t know for a bit as to whether the fee change impacts user retention on the frontend for the affected trading pairs, we do have some preliminary numbers around revenue. We’re just over 5 full days in and they’ve surpassed $200k in revenue which is ~15mm annual revenue run rate. Annualizing based off 5 days of data is a bad way of projecting fee revenue, but the important thing here is mostly that it’s a sizeable number. What’s more interesting is the cohort data.

Not a ton to unpack here. At least so far, a majority of the revenue seems to be coming from folks swapping with fee payments > $50 which corresponds to a swap amount of at least $33,333.

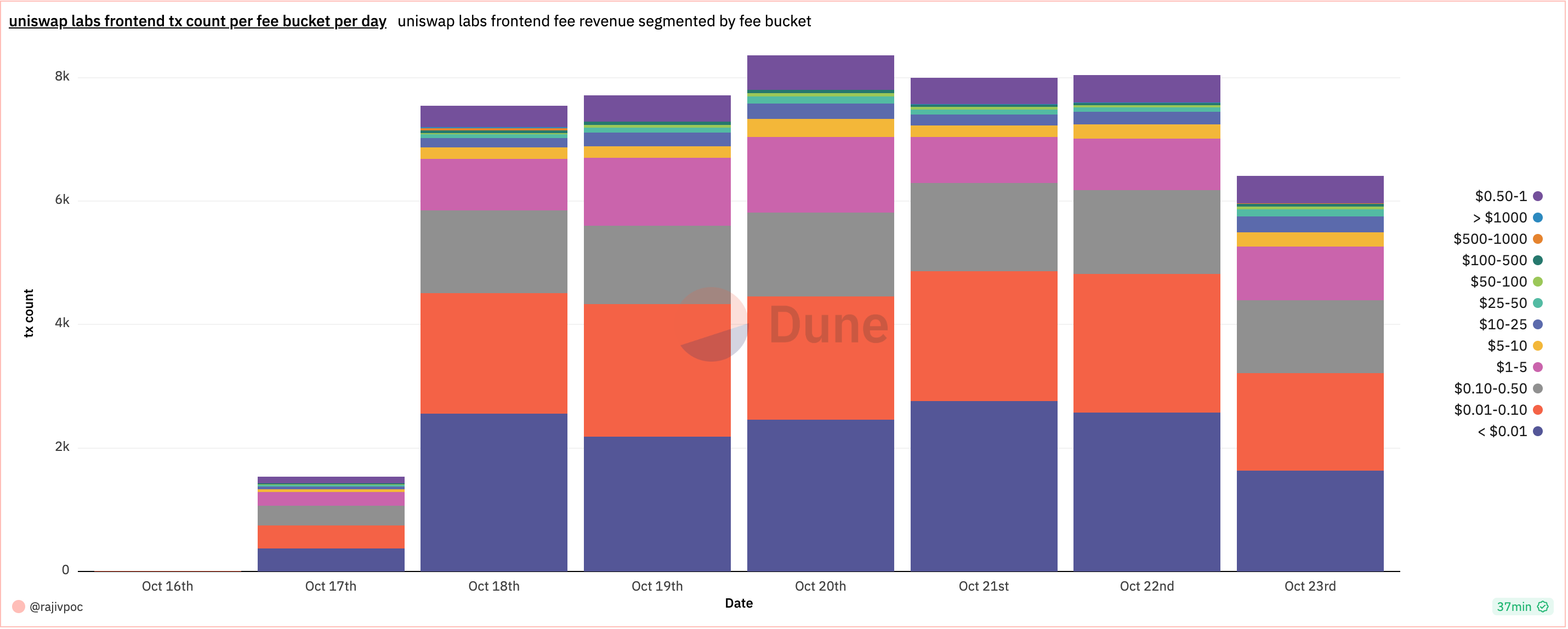

The more interesting part in my eyes, is how few txs there are that contribute to the majority of revenue. The above makes clear that almost all fee paying swaps are coming from smaller swaps. At $5 fee payment, this is an upper bound of a swap amount of $3,333 but most swaps by raw count are with fee payments of < $0.50 which corresponds to a swap amount of $333. On any given day, there are ~100 txs across all chains (Mainnet, Arbitrum, Optimism, BSC, Polygon, Avalanche-C, and Celo) that comprise a majority of revenue!

I haven’t done any work to characterize whether large swaps typically go through Uniswap Labs frontend or somewhere else, how many distinct swappers there are in these buckets, and what sorts of activities these folks are doing on chain. What is clear is that revenue today is largely dependent on these swappers continuing to use the Uniswap Labs frontends. What remains to be seen is if these folks will become more execution sensitive with time (I personally expect this), and how Uniswap Labs might respond to that if at all.

The above charts were created using this query. If you find any errors with the query, please let me know!